Elevate Your Journey with ABWIN Motor Financing

Welcome to ABWIN Motor Financing, your trusted partner for superior motor financing solutions in Singapore. At ABWIN, we understand the significance of reliable and tailored financial support when it comes to acquiring vehicles for your business or personal use. Our commitment to excellence positions us as a first choice for those seeking Motor Financing and COE loans in Singapore.

Our expertise ensures that your journey towards vehicle ownership is not just smooth but also financially sound.

Why Choose ABWIN Motor Financing?

Tailored Solutions

Our motor financing solutions are not one-size-fits-all. We understand the unique needs of our clients and craft solutions that align with their financial circumstances and aspirations.

Competitive Rates

Enjoy competitive interest rates and transparent terms with ABWIN Motor Financing. We believe in providing value-driven financial solutions that empower you to make the most of your investment.

Expert Guidance

Navigating the world of car loans and COE loans can be complex. Our experienced team is here to guide you through the process, offering insights and expertise to ensure informed decision-making.

We are offering Motor Financing Solutions in:

Commercial & Private Vehicles

Certificate of Entitlement (COE)

– 18 years old and above*

– Singaporean and Singapore PR

– Foreigner (a local guarantor is required)*

Company Application:

1. A copy of company ACRA

2. Front and back copies of company director or sole proprietor NRIC

3. Income documents

– Latest 2 years Income Tax Notice of Assessment or

– Latest 3 months of Company Bank Statement

4. Complete application form

Individual Application (Self Employed & Salaried Employee):

1. Front and back copies of NRIC

2. Income documents

– Latest 3 months of computerised payslip or

– Latest 2 years Income Tax Notice of Assessment or

– Latest 12 months CPF Contribution History

3. Complete application form

4. Passport, Proof of Residence and Work Permit with validity date 6 months before expiry date (for foreigners only)

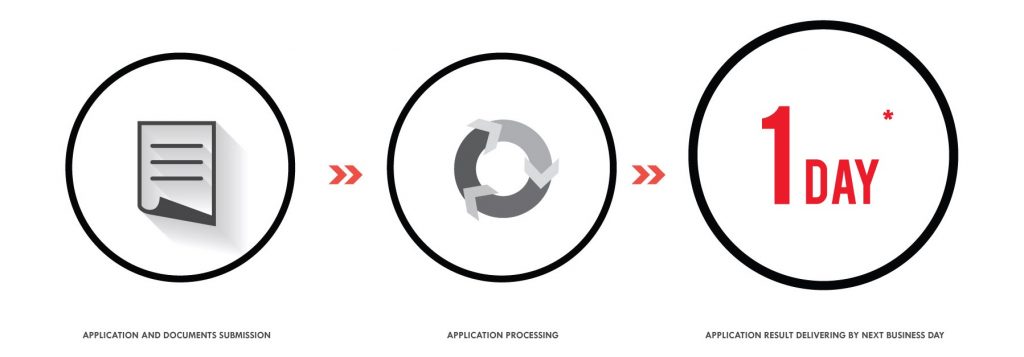

1. Car or commercial vehicle loan submission to Hire Purchase Department. Application can be submitted over counter or via email [email protected]

2. Car or commercial vehicle loan application processed by Credit Loan Team.

3. Loan application result promise to be delivered by next business day**

**In-house loan application only.

Enjoy convenience of car loan payment through these channels:

1) Internet Banking and Mobile Banking (UOB Personal and Corporate account holders)

2) GIRO

3) Cheque

4) Cash / NETS / Credit Card* @ ABWIN Office

5) PayNow (Enter ABWIN Pte Ltd UEN number 199405213N OR scan QR code)

Please indicate your Hire Purchase Agreement Number/Vehicle Number-HP as a reference for the transaction.

*Merchant fees apply

Use this car loan calculator to estimate monthly payments on your next new or used car loan. Simply enter the vehicle price, down payment, term and interest rate to calculate your monthly car loan payment. This car loan calculator will help you determine how much car you can afford.

Motor Financing Calculator

*Terms & Conditions apply.