ABWIN COE LOAN

Considering COE loan to renew your vehicle for either a 5-year or 10-year duration? ABWIN encourages this wise choice, which allowing you to retain your beloved vehicle without bidding farewell to the comfort and familiarity of your ride. Our COE loan options are crafted to make the renewal process straightforward, ensuring that you can continue enjoying the road with peace of mind.

Why Choose ABWIN COE Loan?

Swift Processing and Hassle-Free Services

At ABWIN, we understand the value of your time and that’s why we offer fast

processing and hassle-free services when you apply for your COE financing.

Our streamlined application process is designed for your convenience to

ensure that you experience a smooth and efficient journey

from application to approval.

Top-Notch Service Every Step of the Way

We pride ourselves on delivering top-notch service to our clients. From the

moment you consider COE financing with ABWIN to the successful completion

of your loan, our dedicated team is here to guide you.

We strive to provide not just financial solutions but an experience that leaves

you satisfied with your decision to choose ABWIN for COE financing.

– 18 years old and above*

– Singaporean and Singapore

– PR Foreigner (a local guarantor is required)*

Company Application:

1. A copy of company ACRA

2. Front and back copies of company director or sole proprietor NRIC

3. A copy of vehicle log card.

4. Income documents

– Latest 2 years Income Tax Notice of Assessment or

– Latest 3 months of Company Bank Statement

5. Complete application form

Individual Application (Self Employed & Salaried Employee):

1. Front and back copies of NRIC

2. A copy of vehicle log card

3. Income documents

– Latest 3 months of computerised payslip

– Latest 2 years Income Tax Notice of Assessment

– Latest 12 months CPF Contribution History

4. Complete application form

5. Passport, Proof of Residence and Work Permit with validity date 6 months before expiry date (for foreigners only)

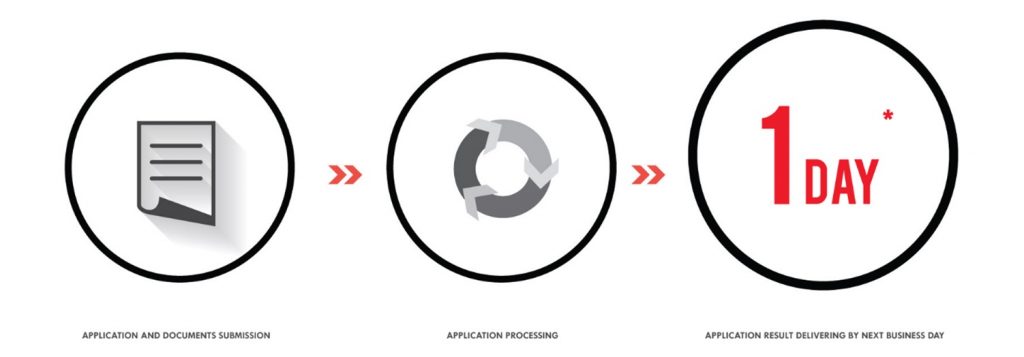

1. Car or commercial vehicle COE loan submission to Hire Purchase Department. Application can be submitted over counter or via email [email protected]

2. Car or commercial vehicle COE loan application processed by Credit Loan Team.

3. COE loan application result promise to be delivered by next business day**

**In-house loan application only.

*Terms & Conditions apply.